Whether you're a broker, banker, or business owner exploring a potential sale, this page covers the key questions we get asked most. We may not have the answer to your question right away, but we ensure 100% transparency, 100% of the time. We like to leave it all out on the table.

Our Investment Philosophy and Partnership Model

Purpose-built for founders and designed for scale. We deliver thoughtful partnerships, strategic alignment, and disciplined value creation.

Foundation & Identity

-

The name Innerlight reflects our core belief: that greatest potentials lie within what we often overlook.

It symbolizes clarity, conviction, and purpose. We invest with intention, seeking to unlock lasting value and empower the people, businesses, and communities they serve.

At its heart, Innerlight is about seeing beyond the obvious, harnessing insight, next-gen technology, and human connection to create impact where most investors don’t.

-

We are sector-agnostic, but primarily focus on essential business services and tech-enabled services. We look for companies with strong fundamentals, recurring revenue, and clear growth potential — especially those positioned to serve or expand into high-growth U.S. markets. Most of our partners are founder- or family-owned businesses.

-

For platform investments, we target businesses with $1–10M in EBITDA , we go higher for the right opportunity. For add-on acquisitions, we’re flexible and consider opportunities of any size.

-

While we have deep expertise and networks in Hispanic markets domestically and abroad, we invest in a wide range of businesses across all demographics. Our cultural fluency simply allows us to unlock additional growth opportunities for companies ready to scale into this high-growth segment.

The U.S. Latino economy represents over $4 trillion in GDP — larger than the U.K, India, and France — and remains underserved by traditional private equity and credit strategies. We view this as a structural capital dislocation with asymmetric upside. Our underwriting always prioritizes fundamentals, execution potential, and value creation levers. Cultural fluency is a competitive edge that drives origination, operational access, and commercial growth across one of America’s largest demographic growth engines.

Strategy & Philosophy

-

Partnership means we’re hands-on, but not overbearing. We bring operational expertise, talent, technology, and strategic support — while ensuring founders and teams maintain their unique vision and culture.

-

We’re relationship-first. We don’t show up with egos or jargon. We bring next-gen thinking, but we invest with old-school values: handshake trust, midwestern work ethic, and doing right by people. We’re also minority-owned and bring cultural perspective that helps connect your business with broader markets, particularly the high-growth U.S. Hispanic market. Our goal is to build enduring value alongside founders, not exit at the first opportunity.

-

Yes — responsibly. We use debt to support growth and liquidity, not to over-leverage or jeopardize a business. We tailor the capital stack to each deal to ensure sustainability and resilience.

-

Yes. We encourage it. Many founders choose to “roll over” their equity proceeds so they stay invested in the business's next chapter. This can create meaningful upside while still allowing you to de-risk and take chips off the table.

Experience & Credibility

-

We may be next-generation in age, but our paths have been anything but ordinary. We’ve earned our place at highly selective, blue-chip institutions the same way many founders built their companies — with grit, discipline, and an obsession with doing things right. That drive was instilled early, watching our families work for every opportunity.

We know what it means to build something meaningful from scratch. And we don’t do it alone. We bring a deep bench of trusted advisors, seasoned operators, and a diverse capital network that opens doors and drives outcomes. Our youth is your edge, it means fresh thinking, relentless work ethic, and a mindset.

-

Our team blends institutional training with real-world experience working alongside growing lower middle market businesses. We apply the same level of rigor, strategic thinking, and financial discipline found at top-tier firms, but we’ve also rolled up our sleeves inside founder-led companies with less than 20 employees. That balance lets us speak both languages: Wall Street and Main Street.

In addition to professional experience, our team brings a competitive edge and discipline earned through collegiate athletics, having played a variety of competitive sports at the university level. That background sharpened our resilience, teamwork, and leadership DNA—traits we now apply in every deal and partnership we enter, including our day to day lives.

-

The real risk is partnering with a firm that treats your business like a spreadsheet and micromanages. At Innerlight, we’ve seen what works, and what doesn’t, from some of the most established investment firms in the industry, including emerging investment platforms. We’ve learned from their strengths, but just as importantly, from their blind spots and missteps. That perspective shapes how we operate — with guided intention, discipline, and respect.

We’re selective with our partnerships and bring an elite, institutional-level toolkit to every investment, tailored with the care of a founder-led firm.

Owner Concerns & Legacy

-

Absolutely. We specialize in working with owners who care about how their business, people, and reputation are treated. We move forward only when we believe we can honor and build on what you've created, not break it apart.

-

Not unless it’s needed. Our goal is to build around what’s working. We back great teams and invest in intelligence infrastructure, tech, and talent only as needed. Never just for the sake of change.

-

Yes. Some founders stay on as board members, advisors, or in operational roles. Others transition out over time. We work with you to design a plan that best aligns with you and your family’s goals.

-

Yes. We know this can be overwhelming. Innerlight’s partners and advisors have executed on a wide variety of deals in the lower middle market, over $500 million of equity invested across new platforms, add-ons, recapitalizations, growth investments, etc.

We will walk you through every step from diligence to closing with transparency and respect. We handle the heavy lifting, so you can focus on your team and your transition.

Timing and Next Steps

-

Once we have the right information, we move quickly. We can close in as little as 30–75 days, depending on the business's complexity and how prepared the financials are.

-

We’d love to keep the dialogue going, drop us a note here.

We’ll handle next steps and set up an introductory call to get your questions answered.

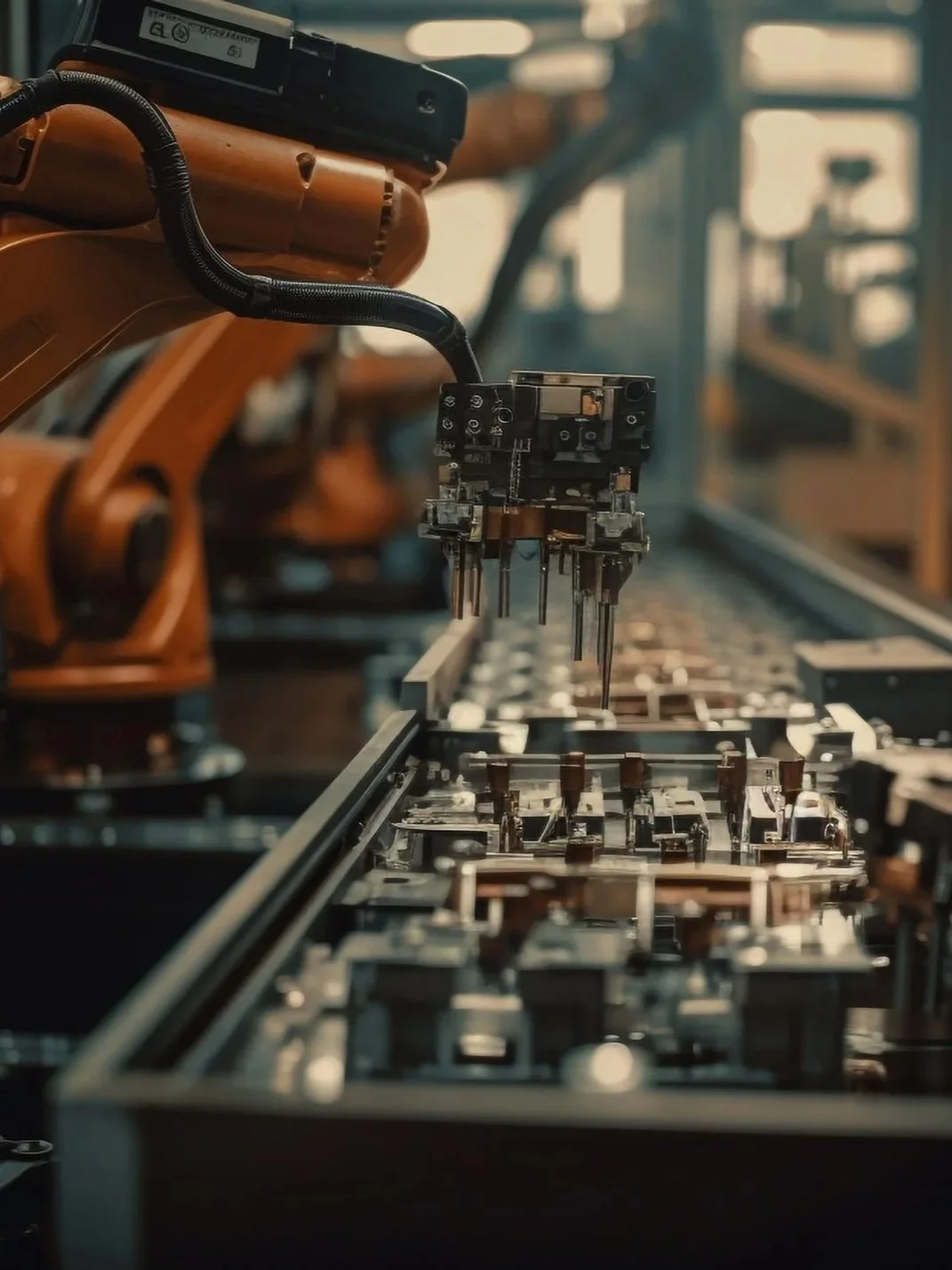

Harnessing AI to Drive Smarter Investments

In an increasingly data-driven economy, the best opportunities go to those leveraging technology to make faster, smarter decisions.

-

100%. One of the ways we create value post-close is by using our proprietary tools and industry data feeds to identify complementary businesses that could make your company stronger — whether through new customers, talent, or geographic coverage.

-

We don’t use AI for the sake of flash. We use it to create smarter growth. Our proprietary data intelligence tools help identify where your business is leaking revenue, where pricing can be optimized, and how customer behavior is trending — so we can make sharper decisions, faster. It’s about improving operations, not complicating them.

-

No. We meet you where you are. Our AI and analytics layer supports your operations in the background, helping us uncover insights and efficiencies without disrupting the day-to-day. We’re here to enhance, not overhaul.

-

We’ve built proprietary tools that help us:

Analyze financial performance in real-time

Predict customer churn and lifetime value

Identify ideal acquisition or partnership targets

Benchmark your business against others in your space

Optimize pricing, staffing, and capital allocation

These tools give your business a strategic edge, without burdening your team.

-

Yes. Our systems help you better understand your customers and your team. We can surface patterns in loyalty, attrition, and satisfaction so you can double down on what works. This isn’t about replacing the human side; it’s about equipping it with sharper tools.

-

Definitely. Most of the companies we seek to invest in aren’t digital-first. But they’re often sitting on valuable data they’re not fully using. We help to collect and unlock that data to drive smarter growth, better forecasting, and better capital decisions.

-

Only if you want to. We’re not in the business of forcing change. If new tools can improve outcomes like better margins, visibility, or team productivity, we’ll suggest them. But it’s always a collaborative conversation and rest assured you will have a say in this.

-

We treat your business information with the highest level of confidentiality and security. Our data systems follow enterprise-grade cybersecurity standards, and we never share or expose your data without explicit consent. Trust is non-negotiable for Innerlight.

-

We use AI to spot underserved customer segments, high-performing territories, and pricing gaps. This helps us target marketing spend more effectively, develop new offerings, and win business from slower-moving competitors. We know where to look and how to strategically penetrate.

-

Our tools assess thousands of market signals from customer behavior to competitor trends to help us prioritize the best growth bets. It means less guesswork, fewer wasted dollars, and a more focused path to scaling your business profitably.

-

Absolutely. In fact, it often works best with niche and local businesses. We can help uncover hidden demand, improve local marketing precision, and even evaluate which nearby zip codes or customer types are most profitable to expand into.